SaaS Support in APAC: How to Scale Customer Experience with In-House, Outsourced, and Hybrid Models

The Asia-Pacific (APAC) region has rapidly emerged as one of the most promising markets for SaaS companies. With countries like India, Singapore, Japan, and Australia adopting cloud-based solutions at unprecedented rates, APAC is expected to contribute over 30% of global SaaS revenue by 2025. The opportunity is undeniable, but so are the challenges.

For SaaS companies, revenue potential alone isn’t enough to succeed. Customer support in APAC is a make-or-break factor. According to Zendesk’s CX Trends Report, 61% of APAC customers would switch to a competitor after just one bad support experience. This shows that providing fast, localized, and culturally sensitive support is not optional, it’s critical for growth.

Many SaaS companies entering APAC underestimate the complexities of customer support in the region. From managing multiple time zones to providing multilingual support, the operational challenges can easily slow down expansion if not addressed strategically.

This guide walks through why SaaS support in APAC is challenging, explores in-house, outsourcing, and hybrid models, shares cost benchmarks, and offers actionable steps for building scalable, high-quality support.

Why SaaS Support in APAC Is Challenging

Expanding support into APAC is far more complicated than opening a new sales channel. Several region-specific challenges can affect customer experience and, ultimately, business growth.

1. Time Zone Coverage

APAC spans 11 time zones, from Japan to Australia to India. Customers expect quick responses during local business hours, yet a support team in Europe or the U.S. operates during what is effectively “off-hours” for APAC clients.

For example, early-stage SaaS startups often struggle to provide live support across these regions. Delayed responses of 12–24 hours frustrate customers and can cause churn. Companies entering APAC must consider staffing strategies, either through local hires, outsourcing, or a hybrid mix, to ensure coverage aligns with customer expectations.

2. Language and Cultural Nuances

While English is widely used in countries like India and Singapore, many APAC markets require native-language support. Japan, South Korea, and parts of Southeast Asia place a high emphasis on formal communication and culturally appropriate responses.

Salesforce Japan recognized this early and invested in native-language support teams, ensuring enterprise clients received precise, formal communication. The lesson here is clear: multilingual SaaS support is crucial for APAC customer satisfaction, particularly when dealing with enterprise-level contracts.

3. SLA Expectations

Enterprise clients in APAC expect clearly defined Service Level Agreements (SLAs). Questions often arise around response times, escalation procedures, and after-hours coverage.

This creates a classic dilemma for growing SaaS companies. Early-stage teams may only handle 10–30 tickets per week, making it challenging to justify a 24/7 support operation. To overcome this, some companies adopt tiered support strategies, with in-house staff handling complex tickets and outsourced teams managing high-volume Tier 1 queries.

4. Cost & Talent Challenges

Support costs vary widely across APAC:

- India & Philippines: USD 5–10/hour (outsourcing-friendly)

- Singapore: USD 15–20/hour

- Japan: USD 20–25/hour

- Australia & New Zealand: USD 25–40/hour

Beyond salaries, companies must consider recruitment, onboarding, and training costs. Attrition rates in APAC support roles can reach 30–35% annually, adding further hidden costs. Without careful planning, APAC expansion can become costly and inefficient.

5. Scaling with Fluctuating Demand

Early expansion often involves unpredictable ticket volumes. One week may see 50 tickets; the next, only 5. Hiring full-time staff in high-cost markets for such volatile demand can burn cash quickly. Many SaaS companies rely on outsourcing or hybrid models to manage this variability without compromising customer experience.

In-House Support: Pros, Cons, and When It Works

In-house support gives SaaS companies direct control over customer interactions and is particularly valuable when handling complex products or high-value clients.

Pros:

- Deep product knowledge enables faster resolutions.

- Full control over communication tone and style.

- Direct alignment with product and engineering teams.

Cons:

- High costs in markets like Singapore, Japan, and Australia.

- Recruitment and onboarding delays can slow expansion.

- High turnover (30–35% in APAC) requires continuous hiring.

- Limited flexibility to adjust staffing based on ticket volumes.

When in-house makes sense:

For enterprise accounts, some companies retain a small, dedicated in-house team in key markets while outsourcing routine queries. This approach ensures that complex issues are handled expertly while keeping overall costs manageable.

Outsourcing Support in Asia-Pacific

Outsourcing is increasingly popular for APAC SaaS expansion. It allows companies to scale quickly, maintain multilingual support, and reduce operational costs, especially for Tier 1 queries.

Pros:

- Cost-efficient: pay per hour or per resolved ticket.

- Scalable: quickly add coverage in new regions or during peak periods.

- Access to multilingual talent, including Japanese, Mandarin, and Korean.

- Many outsourcing partners offer enterprise-ready SLAs and 24/7 coverage.

Cons:

- Reduced direct control over quality.

- Onboarding and training external teams requires planning.

- Vendor quality varies, so due diligence is critical.

Example (sparingly used):

Freshworks leveraged outsourcing in India to provide multilingual support for APAC clients, allowing them to maintain fast response times without building multiple high-cost in-house teams.

Tip: Choose partners experienced in SaaS support and with robust escalation processes to avoid customer experience pitfalls.

Hybrid Models: Best of Both Worlds

Many SaaS companies find that a hybrid model, combining in-house and outsourced support, offers the optimal balance of control, cost, and scalability.

- In-house: Manages Tier 2/3 queries, complex troubleshooting, and enterprise clients.

- Outsourced: Handles Tier 1 queries, after-hours coverage, and fluctuating ticket volumes.

Example (sparingly used):

Canva’s hybrid approach combines internal teams for complex queries with outsourced teams handling volume-based support. This model allows for scalable coverage without compromising quality.

The hybrid approach is particularly effective for startups and mid-sized SaaS companies entering APAC. It provides flexibility and allows teams to adapt to growth without overspending.

APAC Cost Benchmarks & Budgeting

| Country | Outsourcing Rate (USD/hour) | Notes |

|---|---|---|

| India & Philippines | 5–10 | Cost-efficient for Tier 1 support |

| Singapore | 15–20 | Strategic for enterprise clients |

| Japan | 20–25 | High due to native-language needs |

| Australia/NZ | 25–40 | Comparable to US/EU rates |

Hidden costs to budget for:

- Recruitment and onboarding

- Training and knowledge transfer

- Attrition and employee replacement

Lesson: SaaS companies should start with flexible models like outsourcing or hybrid support during early expansion, and gradually invest in in-house teams as volume grows.

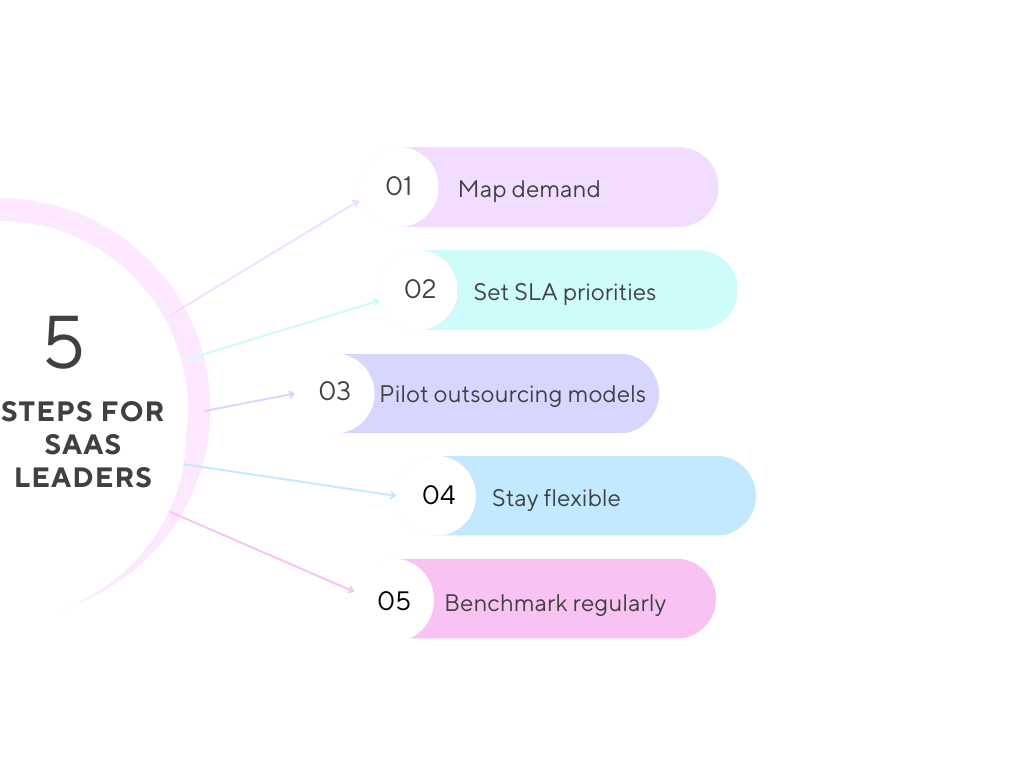

Actionable Steps for SaaS Leaders

- Map demand: Estimate ticket volumes by region, time zone, and language requirements.

- Set SLA priorities: Decide what matters most — speed, coverage, language support, or escalation processes.

- Pilot outsourcing/hybrid models: Test small teams for 3–6 months to measure cost vs customer satisfaction.

- Stay flexible: Revisit staffing models quarterly as ticket volumes change.

- Benchmark regularly: Leverage reports from Deloitte, Gartner, or PwC to guide budgeting and vendor selection.

By following these steps, SaaS companies can scale customer experience in APAC SaaS efficiently while controlling costs.

Conclusion: Key Takeaways

Expanding SaaS support in APAC is both an opportunity and a challenge. Here’s what matters most:

- APAC expansion = opportunity + complexity

- In-house = control but costly

- Outsourcing = scalable but requires vendor diligence

- Hybrid = best for most SaaS startups starting out

Support is no longer a back-office function, it’s a growth driver. By combining the right people, processes, and partnerships, SaaS companies can scale efficiently, provide high-quality multilingual support, and thrive in the diverse APAC market.

Ready to scale your support for APAC growth? Let’s show you how!